Table of Content

Home currency adjustments are normally recorded to prepare financial statements, so that balances held in foreign currencies can be converted to the exchange rate as of the financial statement date. If foreign balances were not adjusted to current exchange rates, the balances reported on the balance sheet could materially mis-state a firm’s financial position. The home currency adjustment records an exchange gain or loss to reflect the change in the value of a firm’s balance sheet accounts. This has been the case for many years, and despite it being repeatedly reported as a bug, and despite Intuit releasing a shiny new version of Quickbooks every single year, it has never been fixed.

Next, debit 990 to the Exchange Gain/Loss Unrealised account and save the journal. A home currency adjustment journal is a journal to adjust the home currency value; therefore, the foreign currency balance of the foreign currency bank account remains unchanged. Pass a home currency adjustment journal to debit SGD0.02 to the foreign currency bank and credit SGD0.02 from the home currency bank.

Manually Adjust Home Currency

Financial statement reports such as a P & L or balance sheet are always in your home currency. Some reports show foreign balances, while other reports provide the option of showing both home currency and foreign balances. The Exchange Gain or Loss account automatically created by QuickBooks records both realized and unrealized gains/losses. QuickBooks accounting software has multiple characteristics which makes the life easy for the user.

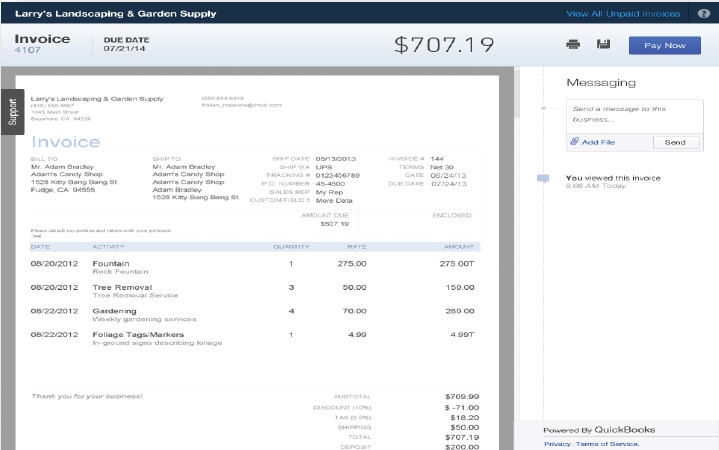

To account for this, at the end of the fiscal year, you perform a “home currency adjustment”. This involves comparing the home and foreign currency balances of the account, and journaling the difference to a currency exchange gain/loss expense account. From the Home Currency Adjustment window, QuickBooks automatically posts home currency adjustments by a General Journal entry to the Exchange Gain or Loss account that is automatically created by QuickBooks as an Other Expense account type. Therefore, debits to this account will represent exchange losses and increase this expense; credits will represent exchange gains and decrease this expense. QuickBooks takes every open balance in the A/R and the A/P in Euro and revalues them as of the valuation date. The total unrealized gain or loss will show up in the row for each of these open transactions, so that you can easily see how all home currency adjustments affect each transaction.

What is Multicurrency in QuickBooks?

Since QB 2013 was the latest public release at the time of the original comment, it would be interesting to see if the behavior in QB 2014, which is out now, alters that. In our experience, for bugs of this type, Intuit tends to fix them in the next version if they do fix them; new releases of the current and older versions get fixes for things that are more serious. Multicurrency, foreign exchange, and currency revaluations are not for sissies. In this blog, all the important information regarding creating home currency adjustments in QuickBooks Online has been mentioned. You can step by step follow the steps regarding this that are all clearly mentioned above.

You have to use a home currency adjustment journal to revalue the foreign currency accounts in Reckon Accounts . If so, manually create new home currency adjustment journal entries for each vendor/customer, specifying both the appropriate A/P or A/R account, and the vendor name in the appropriate journal fields. These need to be done in separate journal entries because quickbooks does not allow you to manually add multiple vendors or customers to the same currency adjustment journal entry for some reason.

Related image with quickbooks desktop home currency adjustment with multi currency

Utilize import, export, and delete services of Dancing Numbers software. How can I generate the Unrealized Gain & Loss report for a period starting on other than Day 1? My old version of QuickBooks used to allow me to input a FROM date so that I can just see the Home Currency Adjustment needed since the end of the last reporting period. Home currency adjustments are booked to a special account, which you can’t manage from within QB. Your best bet is to edit the special account that QB uses to match your desired settings and change the other account to different settings.

After that, you are required to select the Company Preferences tab and select h option Yes, I use more than one currency. Perform the home currency adjustment as usual, under the Company/Manage Currency menu. AccountDebitCreditUSD Accounts Receivable100.50Exchange Gain/Loss – Unrealised100.50This is a home currency adjustment, it should not have any physical impact on your USD owed by the USD Customer. Remember, Multicurrency cannot be turned off once it’s enabled, and it’s available in QBO Essentials, Plus, and Advanced subscriptions. If you open this $0.00 journal entry that you are not ever deleting, you’ll see something really interesting.

How do I create a home currency adjustment?

If you are using multiple currencies, go for the QuickBooks Premier rather than QuickBooks Pro; with a Home Currency Adjustment wizard it does simplify your Home Currency Adjustment process. A few examples will better illustrate how QuickBooks calculates and records home currency adjustments. The Revalue EUR against USD screen appears with today’s date and, in the Open Balances tab, today’s balances appear by default. Then, in the Action column next to the Euro, click on the drop-down next to Edit currency exchange, and then select Revalue currency.

First, you create a foreign currency customer and name it as USD AR Adjustment. Not sure if there’s anything to be done about that, because manually doing a 1c home currency adjustment would then give you a 1c home currency balance in the account instead. Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files. Also, you can simplify and automate the process using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and apply the appropriate features and it’s done.

Learn how to create home currency adjustments in QuickBooks Online. The above blog will help you in knowing the steps to set up and enable this feature in QuickBooks. In case, you face any challenge to understand about multi-currency in QuickBooks or required some more guidance for the same, then do not hesitate to get in touch with Dancing Numbers expert and get consultation. Later click on save option, examine the supplier list page, the supplier name and overseas currency will appear on this list.

The journal entry that it creates, however, is somewhat confusing, and I’m glad that the Memo/Description column has “This is a placeholder for you” in it. Some might see this $0.00 journal entry and be tempted to delete it. And then then the next thing you know, we’ll get invaded and our own home currency will be Freedos. I add a memo, choose to revalue all the Euro balances on that date , and click on Revalue and Save. As someone with many clients using the QuickBooks® multicurrency function, I help them navigate the Multicurrency feature in QuickBooks Online .

Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more. To use the service, you have to open both the software QuickBooks and Dancing Numbers on your system. To import the data, you have to update the Dancing Numbers file and then map the fields and import it. For additional information, seetroubleshooting home currency adjustments. With the help of the above article, you can clear your doubts regarding QuickBooks Multi-Currency.

You have to select New vendor, and fill the details with the employee info. Enter the exact date as the invoice and then choose Save and Close. For the invoice in Transfer Amount enter the value of the payment. After that, you are required to choose the task and later, hit on Download Latest Exchange Rates. In the initial step, you are required to open the Lists menu and choose the Currency List. Among the Lists menu, you need to select the Chart of Accounts.

No comments:

Post a Comment